Wheat is one of the most traded commodities in the world and plays a pivotal role in feeding the global population. Beyond its status as a staple food crop, wheat trading offers opportunities for investors and traders to profit from price movements in the global commodities market. This guide provides a comprehensive overview of wheat trading, from understanding market fundamentals to deploying effective strategies. If you’re interested in exploring the lucrative world of commodities trading, read on.

Understanding the Wheat Market

Wheat is a cereal grain cultivated across the globe, with key varieties including soft red wheat, hard red wheat, and durum wheat. These types differ in texture, protein content, and end-use applications, such as bread, pasta, and pastries. Countries like the United States, Russia, Canada, and Australia are major producers, while nations such as China, India, and Egypt are significant consumers.

Wheat is a cornerstone of the global food supply chain. Its importance extends beyond its use in food production; it also serves as a critical economic driver in agricultural and trade economies. Global events, such as droughts or geopolitical tensions, can ripple through the wheat market, impacting prices and availability worldwide.

The wheat market comprises various participants:

- Farmers and Producers: Focused on growing and harvesting wheat to supply markets.

- Traders and Speculators: Engage in short-term trades based on market movements to profit from price changes.

- Hedgers: Use wheat futures contracts to protect against adverse price movements.

- Governments and Institutions: Manage national food security and regulate exports and imports.

Basics of Wheat Trading

Wheat trading primarily involves futures contracts, which are standardized agreements to buy or sell a specific quantity of wheat at a predetermined price and date. These contracts allow traders to speculate on price movements or hedge against risks in the physical wheat market.

Spot markets, where wheat is bought and sold for immediate delivery, are another avenue for trading. However, futures markets dominate due to their liquidity and accessibility.

Wheat futures are traded on major exchanges, including the Chicago Board of Trade (CBOT), part of the CME Group. The CBOT is one of the most prominent platforms, offering traders detailed contract specifications, such as lot sizes and delivery months. Trading hours vary but often include extended electronic sessions to accommodate global market participants.

Factors Influencing Wheat Prices

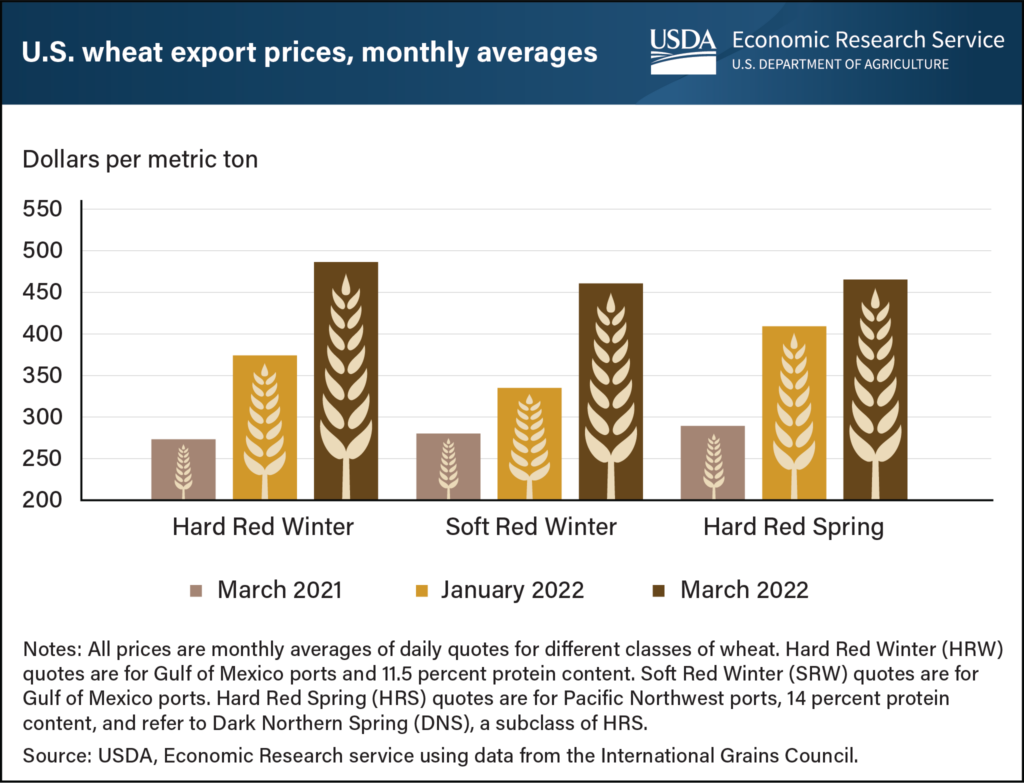

Wheat prices often follow seasonal trends tied to planting and harvest cycles. For example, prices may decline during harvest periods when supply increases and rise during planting seasons due to potential supply uncertainties.

Trade policies, tariffs, and geopolitical tensions significantly influence wheat prices. Events like trade embargoes or international conflicts in wheat-producing regions can disrupt supply chains, causing price fluctuations.

Weather conditions, such as droughts, floods, and frost, directly affect wheat yields. Long-term climate trends, including global warming, also impact production levels and regional growing conditions, influencing global wheat supply and pricing.

Strategies for Trading Wheat

Fundamental analysis involves examining supply and demand dynamics, global wheat production reports, and market-moving events. Key resources include the USDA’s World Agricultural Supply and Demand Estimates (WASDE) reports, which provide critical insights into market conditions.

Traders often rely on technical analysis to predict price movements. Common tools include moving averages, Relative Strength Index (RSI), and trend lines. For example, a moving average crossover can signal potential buying or selling opportunities in the wheat market.

Effective risk management is vital in wheat trading. Strategies include setting stop-loss orders to limit potential losses and diversifying your trading portfolio to spread risk across multiple asset classes.

Tools and Platforms for Wheat Trading

Platforms such as MetaTrader and proprietary broker platforms offer advanced tools for commodities trading. Features like real-time data feeds, analytical tools, and user-friendly interfaces are essential for efficient trading.

Many brokers and financial institutions provide educational resources, including webinars, market analyses, and trading guides. These tools help traders stay informed about market trends and improve decision-making processes.

Risks and Challenges in Wheat Trading

Wheat prices are inherently volatile, influenced by factors such as weather, global demand shifts, and unexpected geopolitical events. Traders must prepare for rapid price swings by using tools like futures contracts or options.

Regulatory changes, including import/export restrictions and compliance requirements, can disrupt trading activities. Staying updated on local and international regulations is crucial.

Black swan events, such as pandemics or sudden geopolitical conflicts, can create significant market disruptions. Diversifying trading strategies and maintaining a robust risk management plan are essential to mitigate these risks.

Successful Wheat Trades

One notable example of a successful wheat trade occurred during the 2008 global financial crisis. While most asset prices plummeted, wheat prices spiked due to supply shortages and increased demand for staples. Traders who had positioned themselves accordingly profited significantly.

Successful traders emphasize the importance of staying informed about market trends and using a combination of fundamental and technical analysis. Additionally, maintaining discipline in risk management often separates profitable trades from significant losses.

Conclusion

Wheat trading offers exciting opportunities for those willing to navigate its complexities. By understanding the market, employing sound strategies, and using advanced tools, traders can capitalize on price movements while managing risks effectively. Whether you are new to commodities trading or looking to refine your approach, the wheat market presents a compelling avenue for growth. To get started, see here for resources and tools that can help you dive deeper into this dynamic market.